TECHNOLOGY & BUSINESS STRATEGY

PRISM is Committed to Research & Development

and Sustainable Innovation

PRISM’s goal is to use proprietary and innovative processing techniques alongside emergent technologies such as Induction Furnaces to disrupt the traditional iron and steelmaking value chain.

PRISM’s Proprietary Altatude Reductive Chlorination Process (“ARCP”)

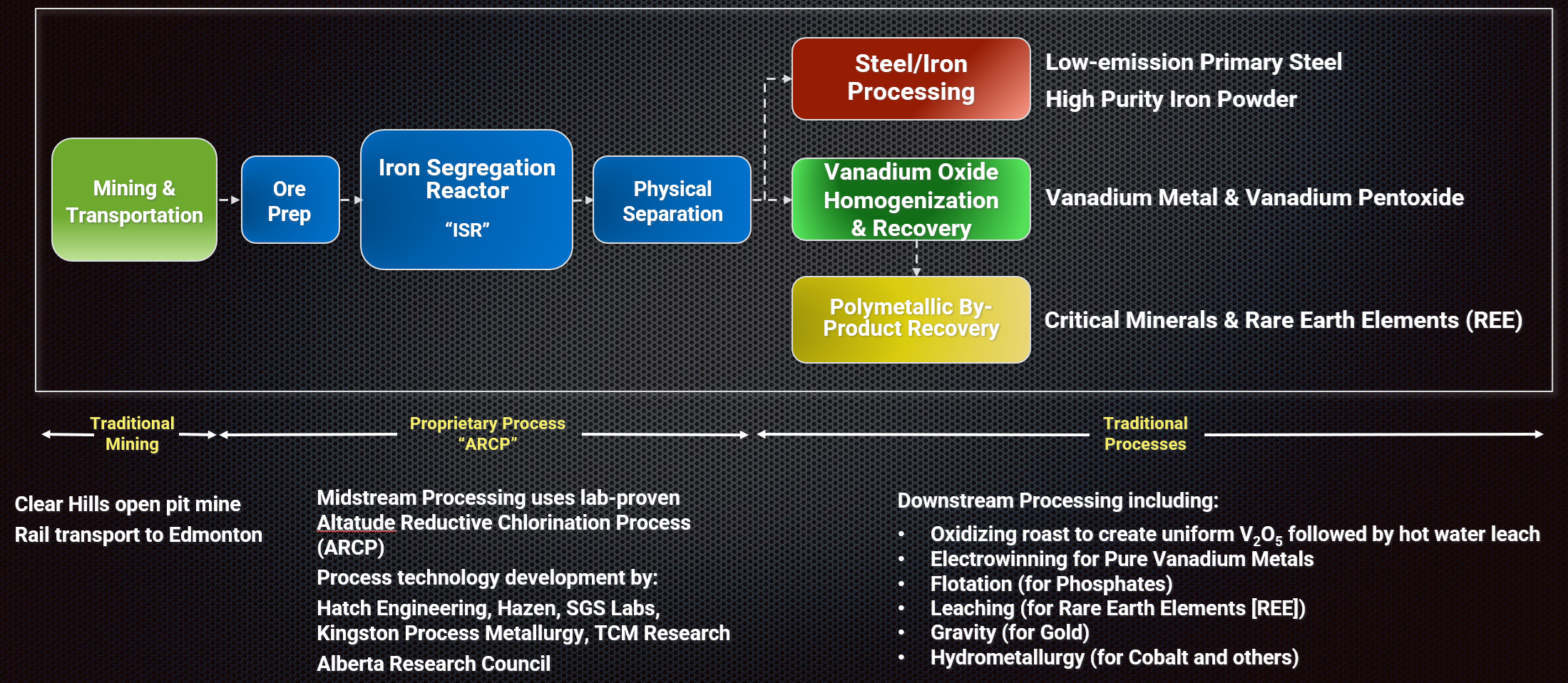

The diagram below provides a strategic overview of PRISM’s mine-to-product process:

Production at a Scale Proportionate to the Industry and Forecasted Steel Demand

PRISM’s aims to produce at a scale to amortize high set up costs such as railheads and mine commissioning. Our stated goal is to produce 3 million tonnes per annum of iron/steel product. At grades of 33% Fe this means run of mine ore production of ~9.5 million tons per annum (a 47 year mine life).

Such production levels mean even the lowest grade minerals will be produced in significant quantities - e.g. Vanadium Pentoxide for example at 17,100 tonnes or 15% of world production. Compare that to producing just 0.15% of global steel production.

Strong Ongoing Steel Demand

Embodied steel per capita is strongly correlated with a country’s level of development. Advanced economies such as USA having ~ 10 tonnes of deployed steel per person. Emerging economies such as sub-sahara African countries have less than 1 tonne of steel per person.

With desired global economic development, and without realistic substitutes, annual steel demand is forecast to increase 60% by 2050 (from 1.8bn tonnes today).

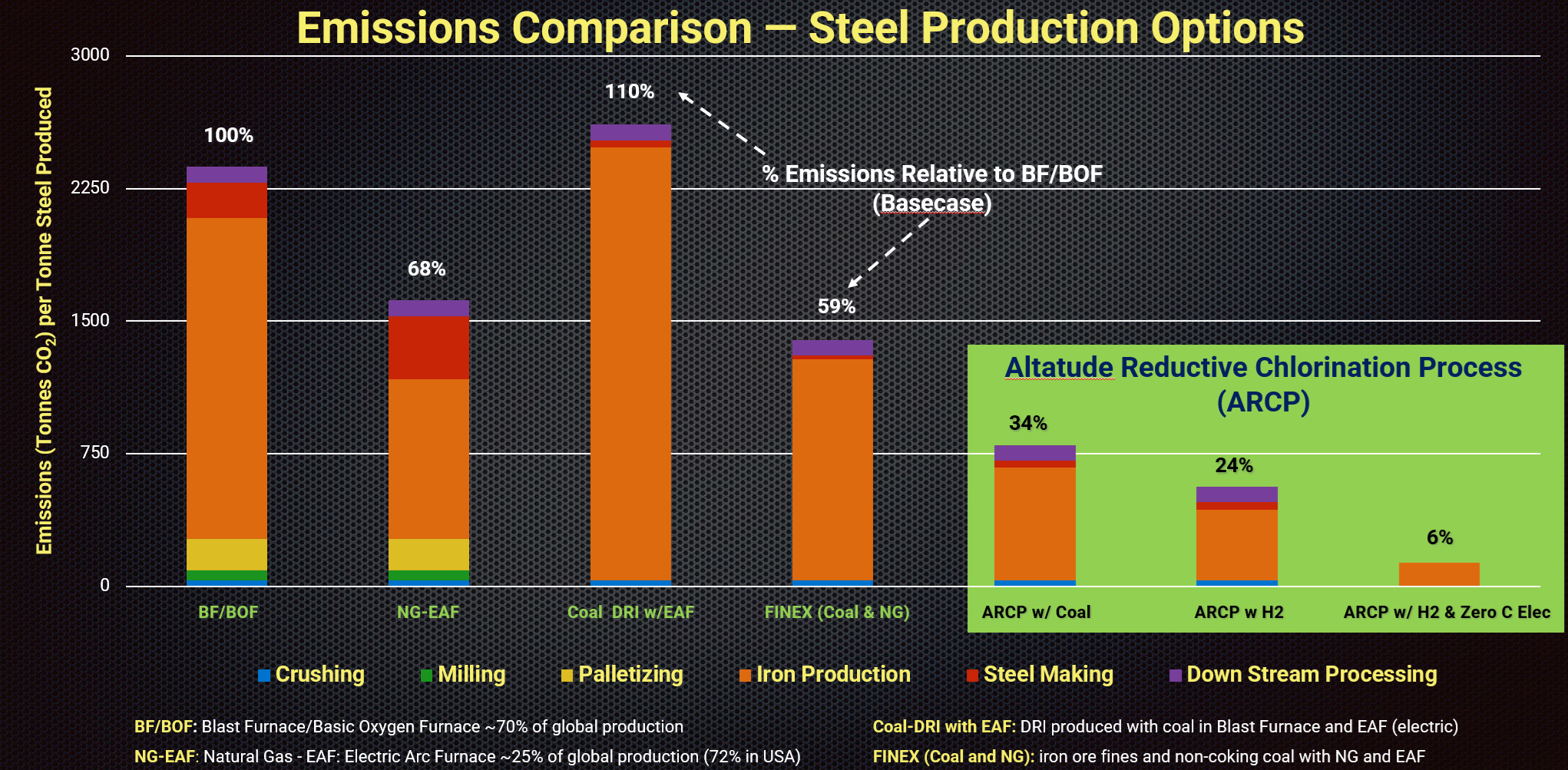

Significantly Lower Emissions than Traditional Steelmaking

Per the emission comparison chart below, a key understanding is that approximately 75% of global emissions from steelmaking come occur in producing the iron feedstock. Much of the literature relating to reduced emissions for steel production only captures a part of the story - as the data typically incorporates leveraging steel scrap. Although use of steel scrap in mini mill Electric Arc Furnaces (EAF) generate lower emissions, reliance on scrap steel cannot address demand growth.

The dominant yet environmentally damaging Blast Furnace/Basic Oxygen Furnace (please see the image below for an overview of the steel supply chain) method is still forecast to produce 40% of steel products in 2050 (down from 70% today). The shear scale of that production means that we should see a host of innovations in these BF/BOF facilities over the coming decades - such as Hydrogen reduction, Natural Gas, Biochar and carbon capture and storage. The embedded capital expense of these enormous integrated steel mill favours process improvement rather than radical overhauls.

In summary, although the wide-scale deployment of EAFs and BF/BOF process improvements are welcome steps towards lower emissions - they are unfortunately not the panacea for this hard-to-abate industry.

PRISM’s reductive chlorination process (PRCP) is an alternative method to create low-emission and high-purity iron feedstock that will be applicable to a range of existing steel making process. That said, although our iron powders could feed BOF steelmaking we anticipate selling our iron powders to EAF mills or will use the powders in-house to manufacture primary steel billets/slabs/blooms.

Consolidation in the Steel Value Chain

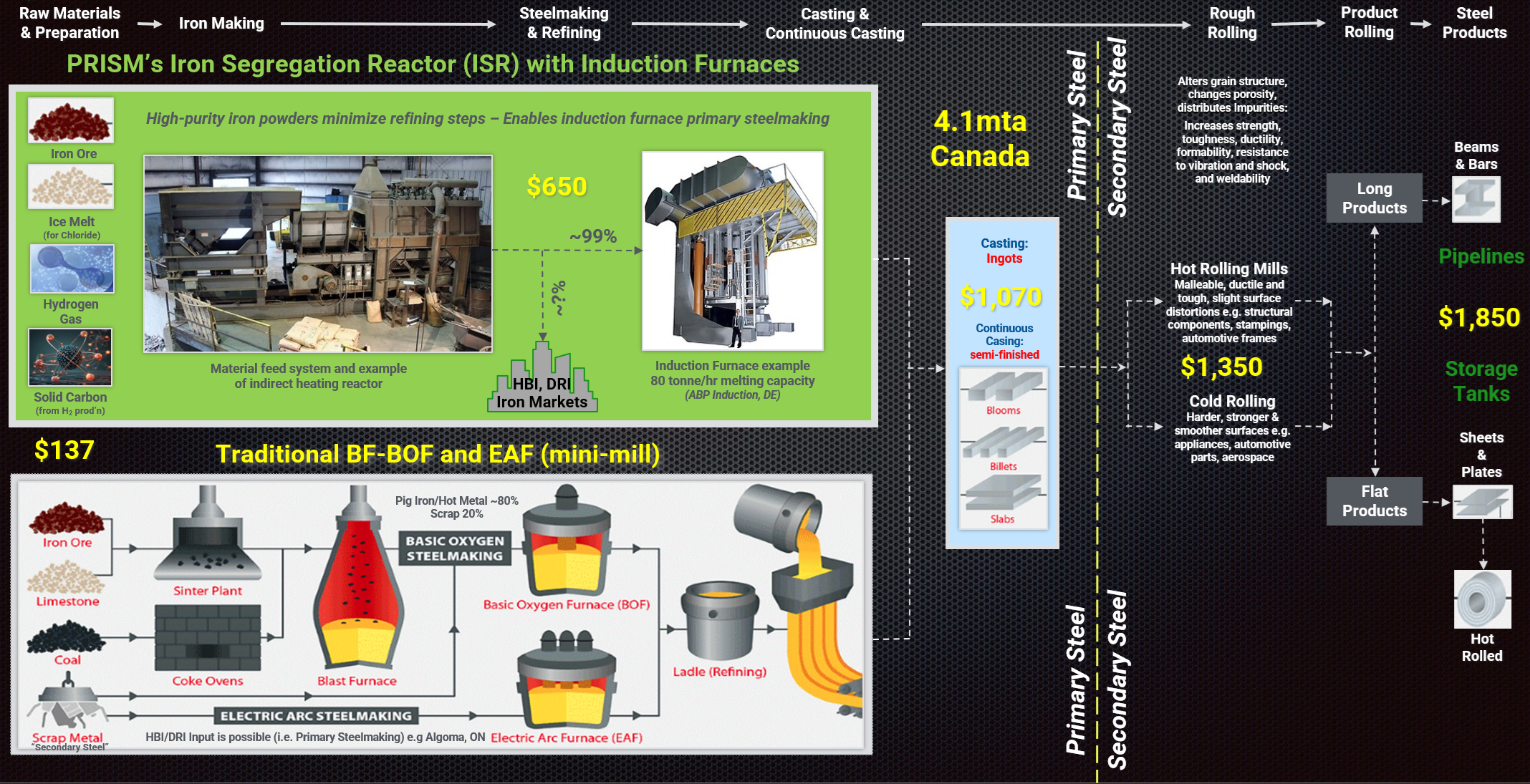

The image below shows the two dominant steelmaking processes (bottom left box) namely BF/BOF with Iron Ore as an input and EAF with scrap steel or DRI as inputs.

The upper (green) box shows PRISM’s process using the Altatude Reductive Chlorination Process (ARCP) Iron Segregation Reactor (ISR) to produce iron powders and using Induction Furnaces to produce primary steels. Sample sales values are shown (yellow text).

To Focus or To Consolidate?

As industries and markets mature different business strategies can be appropriate; in some cases it makes sense to focus and at other times it makes sense to venture up or down the value chain. The term “disintermediation” is another way to describe a consolidation (or “cutting out the middle-man”). It can make sense given the right market conditions and technology impact.

The two situations described below highlight how market maturity can favour different outcomes:

the introduction of the EAF “mini-mill” during the 1980’s and 1990’s decimated the integrated steel-mills in the USA.

conversely around the same time the Asian markets developed and have come to dominate the steel supply based upon integrated steel mills. Indeed 70% of global steel production is still produced in such integrated steel mills in China, India and South Korea.

The strategic advantage of consolidating the supply (vertical integration) is exemplified by the strategies of the Chinese battery and EV companies BYD and CATL - both of whom not only own lithium mines but control production through to batteries and cars. Their vertically integrated supply chains allow them to distribute profits across the production process and out-compete their less integrated competitors.

A desire to "off-shore” externalities such as pollution created national strategies in developed economies such as UK and Germany that decimated domestic steel production. It is fortuitous for these countries that emerging low emission steel making technologies are coinciding with a demand for domestic production (fueled by geo-political tensions) which we feel will significantly affect the steel making industry.

Separation of Iron Production from Steel Production

The steel industry faces strategic transformation forced by a combination of regulatory emission targets, technology enablers, geopolitical tactics and market dynamics. We therefore predict the integrated steel-mill paradigm splitting - with iron feedstock production becoming geographically separated from steel making. i.e. Iron production will be strategically located near resources and/or available low emission energy and steel production (using modern modular and electrical powered furnace options) located closer to the end user.

Such consolidation isn’t a new phenomenon and companies such as Rio Tinto have already made acquisitions in novel steel production facilities and techniques that differ from their typical role as a mining company. Please note that at the bottom of the steel industry overview image above are some examples of this disintermediation (in this case mining companies moving up the value chain):

Vale (world’s largest iron ore producer) has announced a “mega-hub” for Oman which will produce low-emission iron. Vale (likely with a strategic partner) will harness low emission energy (natural gas initially and eventually solar) to produce iron (Pig Iron, Hot Briquetted Iron (HBI) or Direct Reduced Iron (DRI).

In doing so they will move their traditional product supply of iron ore further down the supply chain to equate with the product exiting a Blast Furnace.

Rio Tinto although predominantly a supplier of iron ore also produce rough steel and finish steel products from their site in Sorel-Tracey, QB, Canada. Additionally, their recent partnership with GraviHy aims at producing low-emission iron feedstock.

PRISM will leverage two key benefits of its PRCP process to similarly move up the value chain - selling iron powders to EAF mills and also producing primary steel products:

Refine Early or “Avoid the Need for (steel) Refining”

A key benefit of BF-BOF facilities is their ability to manage differing ore and feedstock grades and impurities. PRISM’s reactor turns ore it into high purity iron powder. By supplying pure iron feedstock we alleviate the need for refining - which opens up a host of alternative steelmaking options…..

Induction Furnaces

Induction Furnaces are a moderately recent technique that provide significant energy savings as compared to EAF. A key weakness however is that Induction Furnaces do not possess a significant refining capability - and thus need a pure feedstock (hence the synergy with PRISM’s pure iron powders).

Note: EAFs also require feedstock with minimal impurities (such as good scrap steel or DRI) - and thus are an avid consumer of high purity iron powders. Induction Furnaces have even less refining ability and therefore require a high purity feedstock even more so.

Although the operating costs for PRCP will likely be higher than the BF-BOF route, assuming accounting for externalities (i.e. pollution [or conversely carbon credits]) as well as revenue credits for PRISM’s polymetallic metals, we are confident that the benefits will outweigh additional process costs.

Steel production in Induction Furnaces using PRISM’s high grade iron powders with pure alloy powders will generate significant energy savings, lower emissions and lower capital and operating costs.

Strategic Optionality on End Product

Retaining an option to sell iron powders or primary steel products means PRISM can adapt and benefit from the more profitable markets. Current plans are to sell 80% of PRISM’s iron production as primary steel products (slabs, blooms, billets) and 20% as iron feedstock.

A third product stream anticipated at ~30,000 tonnes per annum specialized iron powder markets for additive manufacturing and 3D printing.